As a Pro Se litigant, victim of CSA by a BSA leader, participant in this fake Bankruptcy proceding as a creditor with two claim numbers, and someone who gets jailed unlawfully often for standing up for our rights, I have witnessed several disgraceful tactics by the insurance cartel and documented their fraud.

Creditors who are jailed, incarcerated or considered an inmate, are still victims of a crime and denied their right to participate in this BSA Bankruptcy in Delaware. Most County Jails do NOT have Law Libraries. Most State or Federal prison facilities do not know how to handle legal mail or use discretion when delivering sensitive mail nor do they facilitate the participation in the online conference videos. How can those incarcerated participate in a mostly online court proceding, to even know how their attorney represented them? There is evidence that most of the incarcerated claims holders were lumped in to a pool of around 19,000 Victims, and represented by a “Coalition.”

I filed a formal ethical grievance against an attorney registered in California who represents over 19,000 claims holders as a part of this Coalition and the OFFICE OF CHIEF TRIAL COUNSEL in California is investigating my claims as of July 08, 2024.

To defraud broadly means trick or deceive someone at the expense of another for personal gain. In the legal sense, to defraud is to commit fraud that leads to civil or criminal liability.

In civil litigation, allegations of fraud might be based on a misrepresentation of fact that was either intentional or negligent. For a statement to be an intentional misrepresentation, the person who made it must either have known the statement was false or been reckless as to its truth. The speaker must have also intended that the person to whom the statement was made would rely on it. The hearer must then have reasonably relied on the promise and also been harmed because of that reliance.

A claim for fraud based on a negligent misrepresentation differs in that the speaker of the false statement may have actually believed it to be true; however, the speaker lacked reasonable grounds for that belief.

Fraud may be committed based upon withheld information rather than the actual communication. Many laws obligate a person to disclose relevant information and a person may easily defraud another by failing to disclose such information. For example, if a company failed to disclose to new creditors of a previous billion dollar loan, this could be a fraudulent failure to disclose if the lack of disclosure was intended to get the company better financing terms with the new creditors.

A promise that goes unfulfilled may give rise to a claim for fraud only under particular circumstances. For example, in California law, a false promise is only fraudulent if the promisor intended both not to perform on the promise and also that that the promisee would rely on the promise; and, the promisee must have reasonably relied on the promise and been harmed as a result of that reasonable reliance. When the promise was made as part of a contract, most states forbid a plaintiff from recovering under both contract law and tort law.

Lastly, opinions are not usually actionable as fraud except under very specific circumstances defined by either the common law or statutes in each state. In California, for example, a jury may be instructed that an opinion can be considered a representation of fact if it is proven that the speaker “claimed to have special knowledge of the subject matter” that the listener did not have; OR that the representation was made “not in a casual expression of belief, but in a way that declared the matter to be true;” OR if the speaker was in a position of “trust and confidence” over the listener; OR if the listener “had some other special reason to expect” the speaker to be reliable. Once the jury decides that an opinion qualified as a misrepresentation of fact under the circumstances, the plaintiff must still demonstrate all of the other elements of an intentional or negligent misrepresentation already described, such as reasonable reliance and resulting harm.

In criminal law, fraud usually takes very specific forms, such as bankruptcy fraud, credit card fraud, or healthcare fraud. California law, for example, also recognizes distinct crimes for check fraud, access card fraud, insurance fraud, and making false financial statements. Some criminal fraud statutes might be classified under laws forbidding larceny, others under forgery, and others as a crime covered by laws regarding a specific industry, like insurance or banking laws. Suspicions of criminal fraud should be reported to law enforcement authorities.

[Last updated in October of 2022 by the Wex Definitions Team] – https://www.law.cornell.edu/wex/defraud

There are several Constitutional violations that have taken place during this BSA Bankruptcy and I believe we should cite HARRINGTON, UNITED STATES TRUSTEE, REGION 2 v. PURDUE PHARMA L. P. ET AL. “Held: The bankruptcy code does not authorize a release and injunction that, as part of a plan of reorganization under Chapter 11, effectively seek to discharge claims against a nondebtor without the consent of affected claimants. Pp. 7–19”

Here are the citations from the Supreme Court opinion links:

- United States v. Detroit Timber & Lumber Co., 200 U. S. 321, 337

- RadLAX Gateway Hotel, LLC v. Amalgamated Bank, 566 U. S. 639, 649

- Sturges v. Crowninshield, 4 Wheat. 122, 176

- Dewsnup v. Timm, 502 U. S. 410, 420

- Epic Systems Corp. v. Lewis, 584 U. S. 497, 512

- Wright v. Union Central Life Ins. Co., 304 U. S. 502, 513–514 (1938)

- In re Purdue Pharma L. P., 69 F. 4th 45, 56 (CA2 2023)

- In re Purdue Pharma L. P., 635 B. R. 26, 44 (SDNY 2021)

- In re Purdue Pharma L. P., 633 B. R. 53, 83–84 (Bkrtcy. Ct. SDNY 2021)

- Tennessee Student Assistance Corporation v. Hood, 541 U. S. 440, 447 (2004)

- Michigan v. EPA, 576 U. S. 743, 752 (2015)

- School Comm. of Burlington v. Department of Ed. of Mass., 471 U. S. 359, 369 (1985)

- Sheet Metal Workers v. EEOC, 478 U. S. 421, 446 (1986)

- Cooter & Gell v. Hartmarx Corp., 496 U. S. 384, 400 (1990)

- Tanzin v. Tanvir, 592 U. S. 43, 49 (2020)

- NLRB v. Bildisco & Bildisco, 465 U. S. 513, 525 (1984)

- Bartenwerfer v. Buckley, 598 U. S. 69, 81 (2023)

- Czyzewski v. Jevic Holding Corp., 580 U. S. 451, 465 (2017)

- Hall v. United States, 566 U. S. 506, 523 (2012)

- Central Va. Community College v. Katz, 546 U. S. 356, 363–364 (2006)

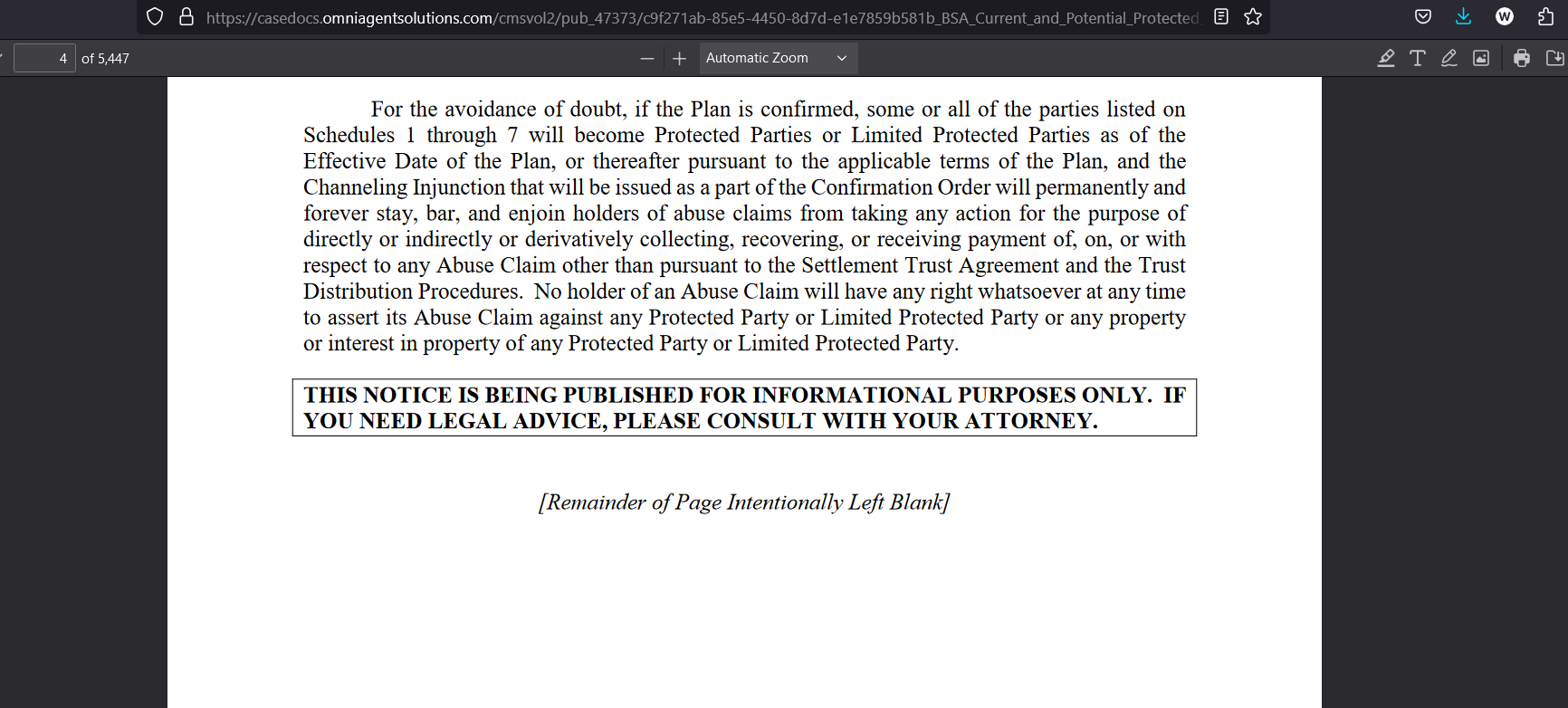

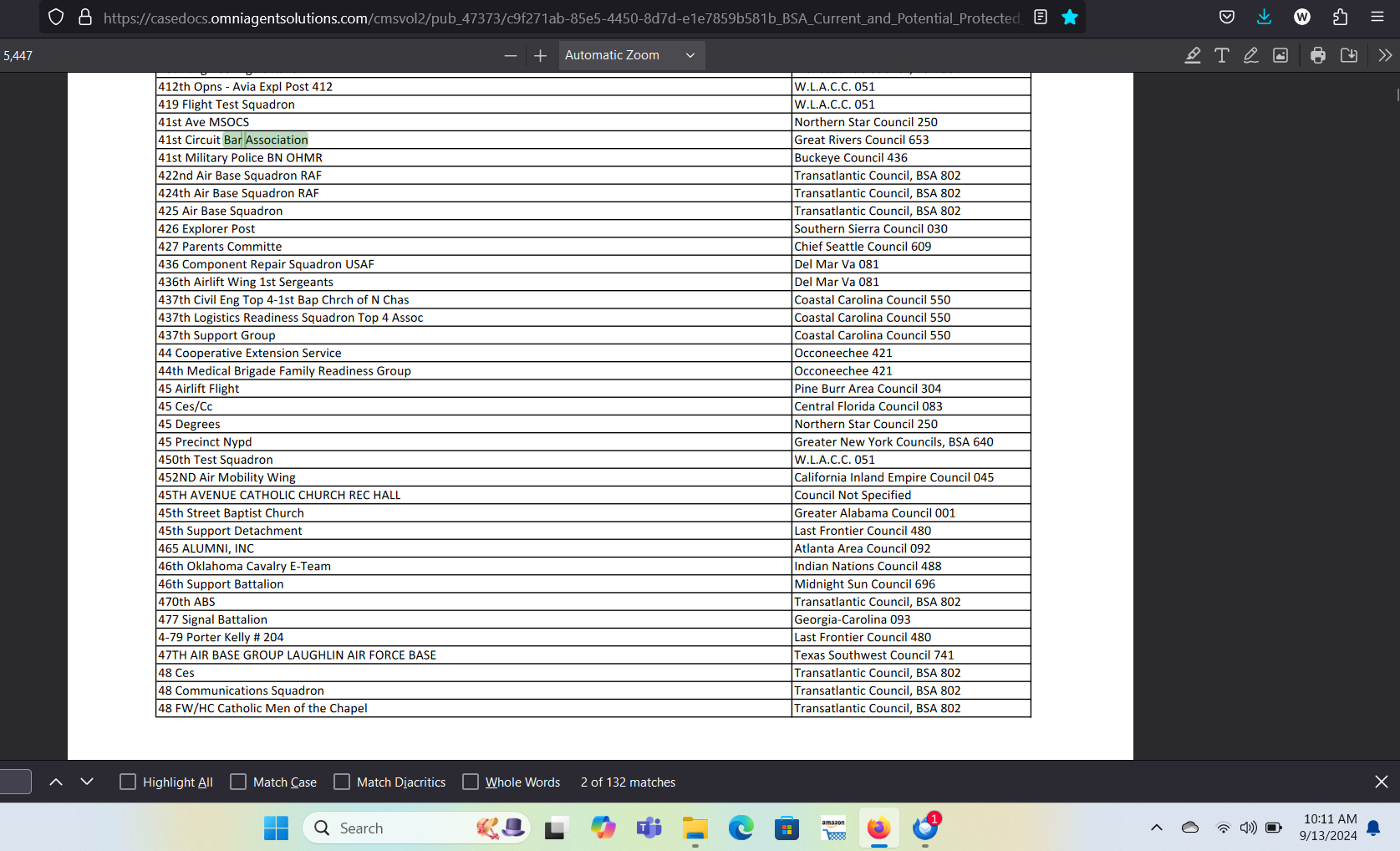

The “in perpituity clause” on page 4 of the Protected Parties Document in the reorganization plan does not meet Constitutional requirements for protected parties according to the Purdue decision. This would allow us to refuse to sign the Protected Parties waiver in order to receive a payout. The Trust has let us down in several ways. I personally have submitted enough evidence that the Bad Faith Suits in Texas are with merit and the insurance companies do not qualify for discharge from liability in their poorly administered reorganization plan.

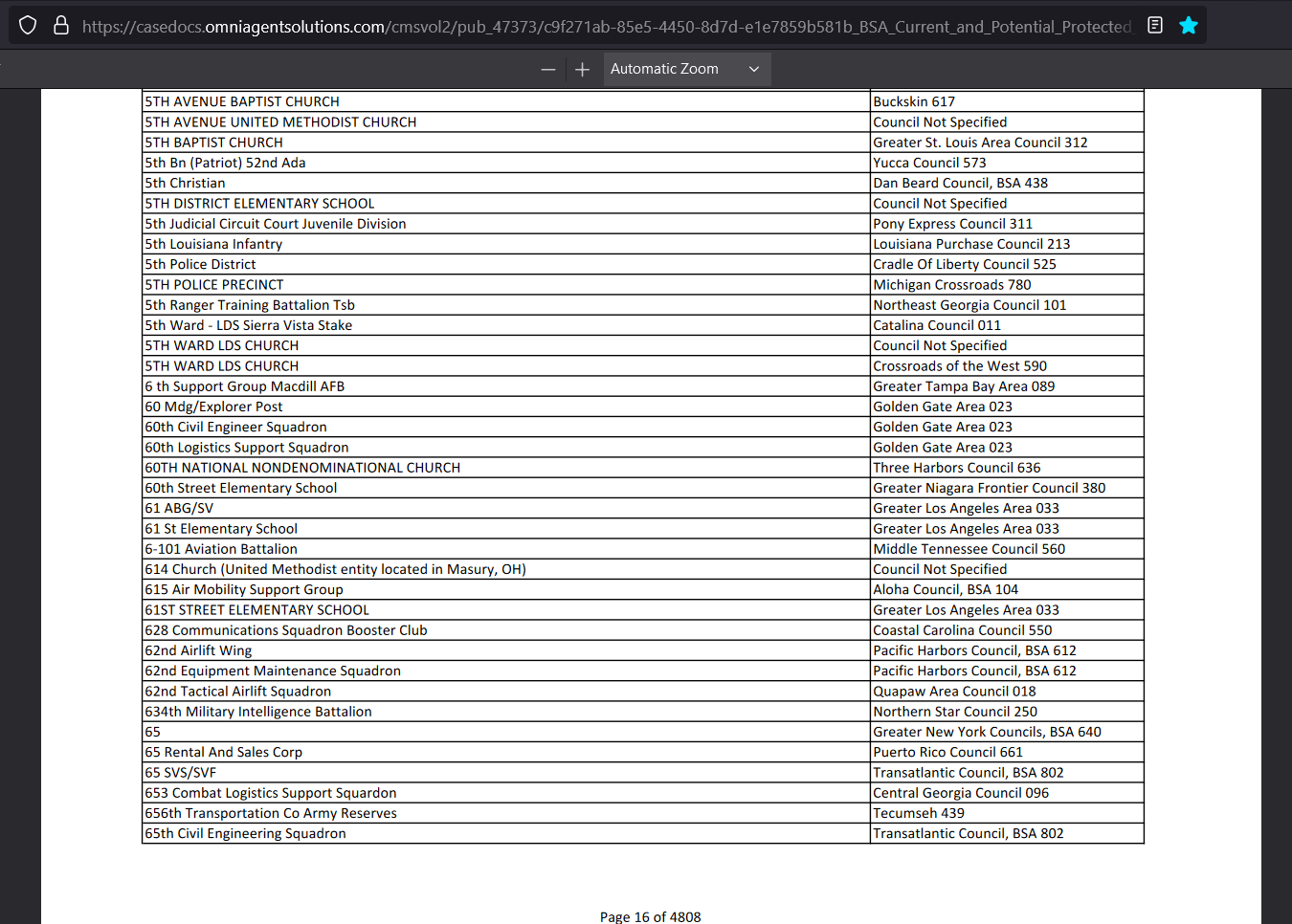

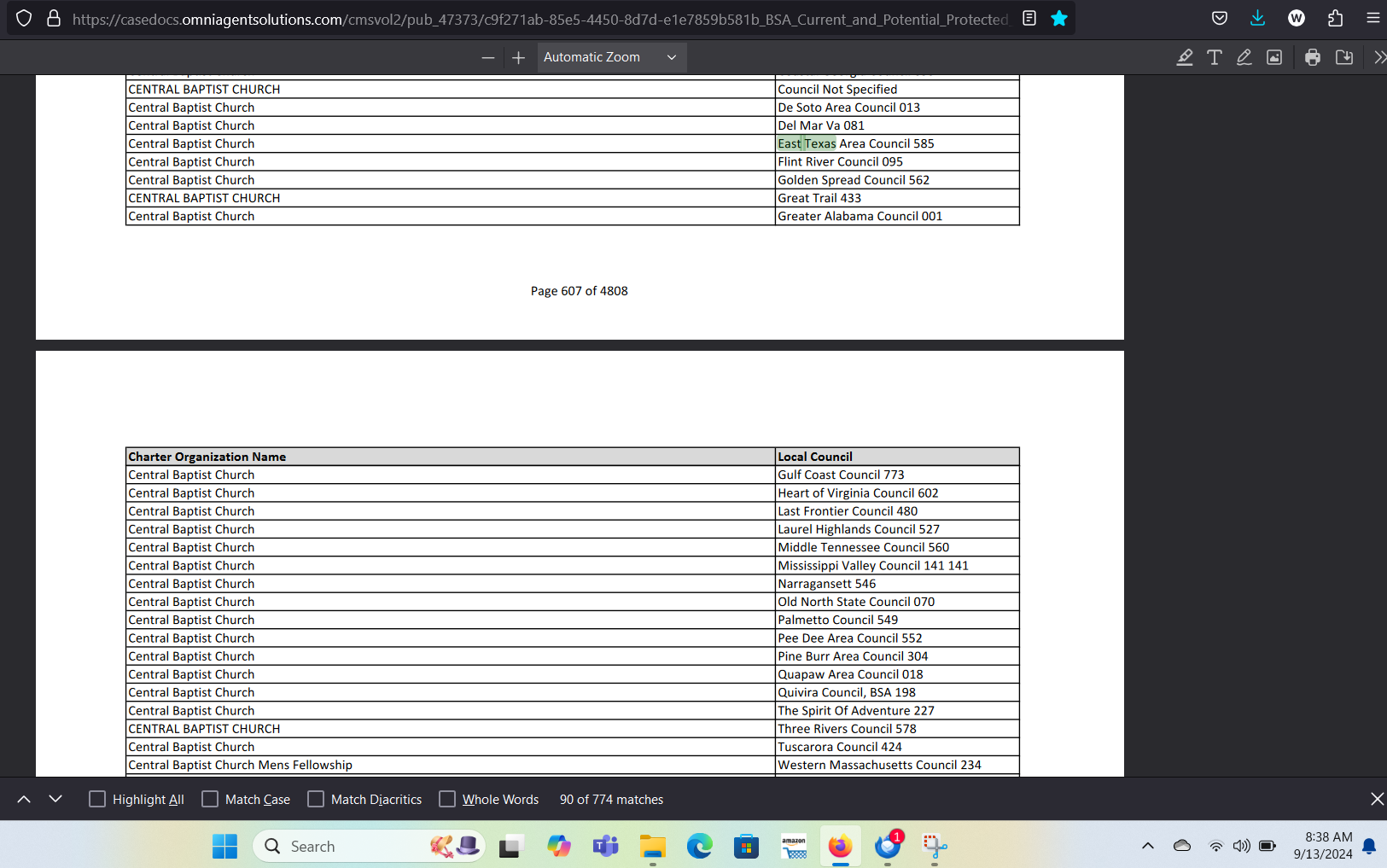

The goal of the insurance companies and the protected parties is for them to not be listed in any form of press release about their participation in the cover up of over 135,000 claim holders in the Boy Scouts of America Bankruptcy.

1 thought on “The Boy Scouts of America Bankruptcy was Conducted to Defraud the Victims of CSA”