There is a reason that this Bankruptcy was not fair. Several reasons, but the main indicator of why this was a complete fraud for the Victims of Childhood Sexual Assault, is because the Boy Scouts of America hired the most ruthless law firms in United States History. This firm was founded to help Millionares go to War. What happens when Millionares in the 1915’s become the Trillionares of today? How did they get there? Lawyers.

The Victims of Childhood Sexual Assault just went up against one of the most powerful cartels to ever exist in history.

The Banking Cartel.

The retirement funds for every single Judge and Justice who touched this Bankruptcy and Appeal process have 1 of 3 retirement funds through Vanguard, Statestreet and Black Rock, if not all 3.

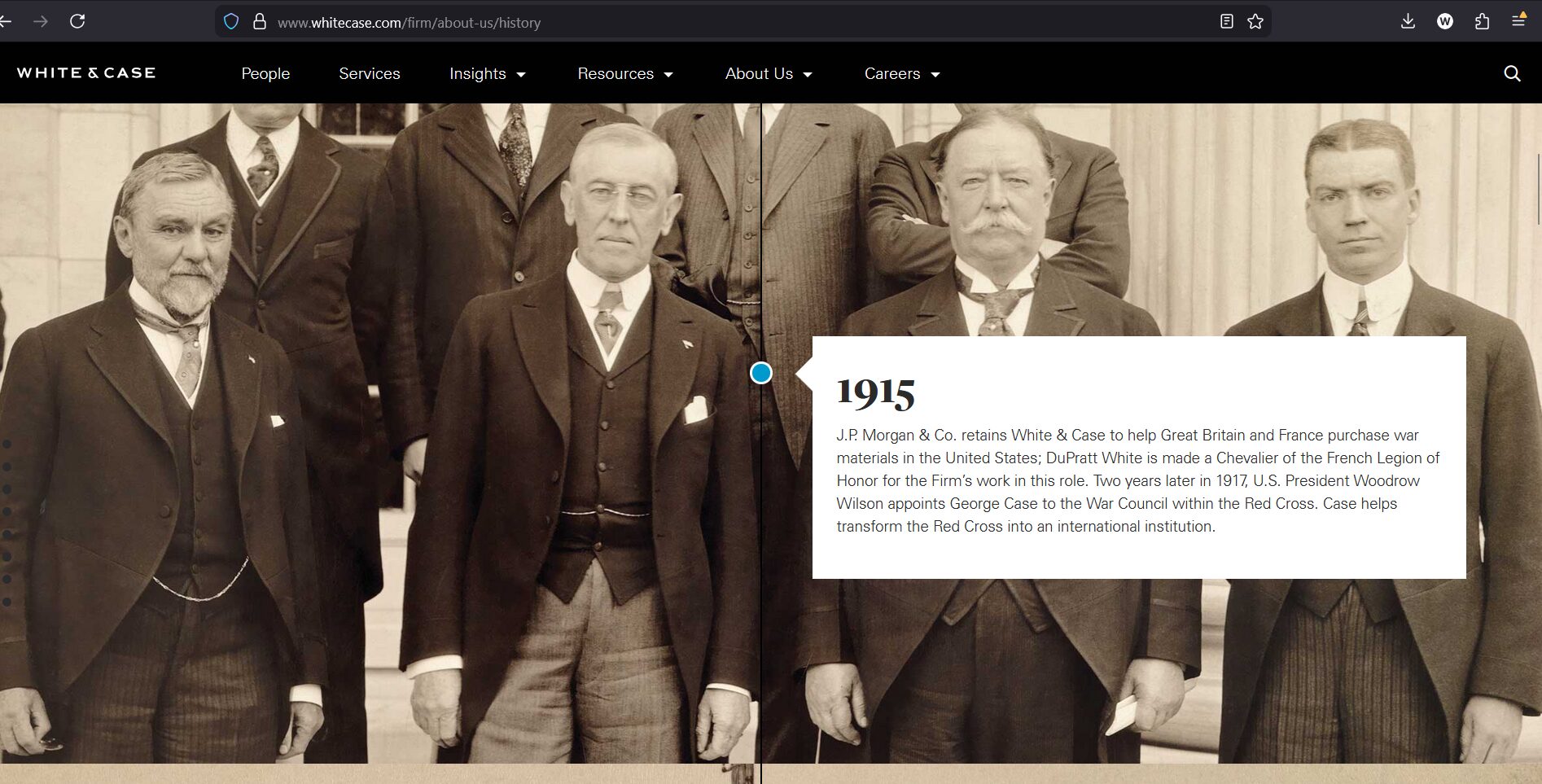

Whilst Reading the news on this Bankruptcy, which are 5 articles since Monday, I noticed a new press release in the news, by Case & White, and clicked on it and read their bragging about representing the BSA and how well they did, and then I clicked on the https://www.whitecase.com/firm/about-us/history About Us link and I was not surprised to see the Titans of Industry that cause most of the Worlds Wars since 1910, being showcased as Founding Partners of that Firm. Make of this what you will, but this information below is why we will never see justice in this situation.

“1915

J.P. Morgan & Co. retains White & Case to help Great Britain and France purchase war materials in the United States; DuPratt White is made a Chevalier of the French Legion of Honor for the Firm’s work in this role. Two years later in 1917, U.S. President Woodrow Wilson appoints George Case to the War Council within the Red Cross. Case helps transform the Red Cross into an international institution.”

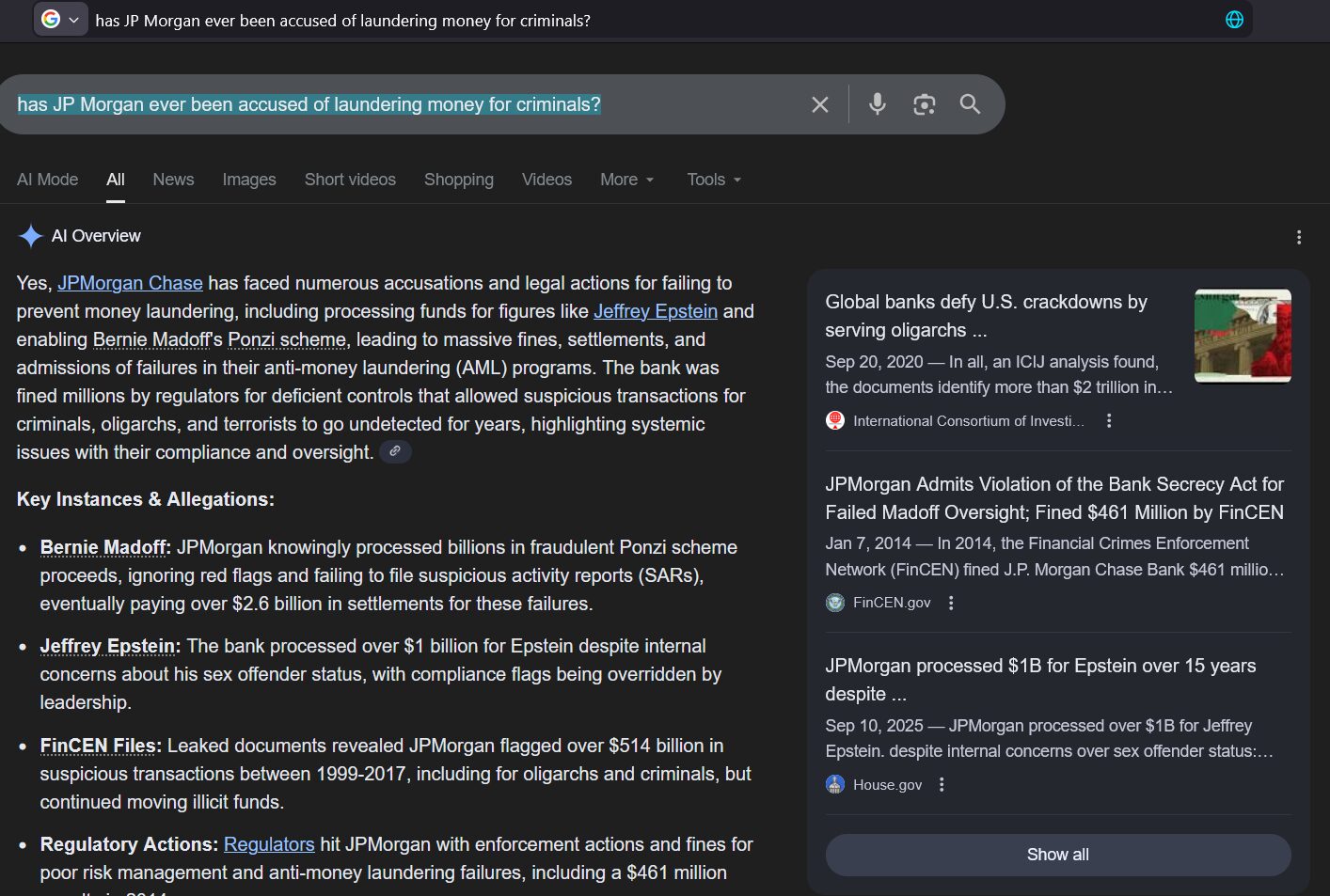

I have asked Google “has JP Morgan ever been accused of laundering money for criminals?”

I have asked Google “has JP Morgan ever been accused of laundering money for criminals?”

“J.P. Morgan is known for protecting wealth, and when they own the majority of these insurance companies through off shore accounts, shell company foldings, (I said that correctly) and underwrite their own fraudulent transactions in the housing market, stocks and bonds and fund poisous companies like Monsanto and Bayer, it shows up in court and in real life.

- Bernie Madoff: JPMorgan knowingly processed billions in fraudulent Ponzi scheme proceeds, ignoring red flags and failing to file suspicious activity reports (SARs), eventually paying over $2.6 billion in settlements for these failures.

- Jeffrey Epstein: The bank processed over $1 billion for Epstein despite internal concerns about his sex offender status, with compliance flags being overridden by leadership.

- FinCEN Files: Leaked documents revealed JPMorgan flagged over $514 billion in suspicious transactions between 1999-2017, including for oligarchs and criminals, but continued moving illicit funds.

- Regulatory Actions: Regulators hit JPMorgan with enforcement actions and fines for poor risk management and anti-money laundering failures, including a $461 million penalty in 2014.

- Criminal Schemes: The bank also faced charges and agreed to penalties for allowing its precious metals and US Treasuries desks to engage in widespread criminal fraud, including spoofing and price manipulation. [2, 3, 4, 6, 8, 9, 10, 11, 12, 13]

JP Morgan Chase does own stock in Vanguard, which every judge and justice who touched this case has a retirement fund through.

JPMorgan Chase & Co. (JPM) does own stock in Vanguard (through its funds like Vanguard Total Stock Market Index Fund and Vanguard 500 Index Fund), but more significantly, Vanguard Group is the single largest shareholder of JPMorgan Chase, holding around 9-9.8% of JPM’s outstanding shares, with its ownership coming from the millions of individual investors in its funds. So, it’s a mutual relationship where both entities hold stakes in each other, typical for large financial institutions.

- Vanguard owns JPM: Vanguard, BlackRock, and State Street are the top institutional holders of JPM stock.

- JPM owns Vanguard (via funds): JPMorgan’s investment funds, particularly index funds, hold shares of Vanguard’s own funds (like Vanguard Total Stock Market Index Fund) as part of their diversified portfolios.

- Indirect Ownership: The vast majority of these shares in both companies are ultimately owned by millions of individual investors who hold Vanguard funds or are clients of JPMorgan.